Biggest Mover Brands in South Africa for 2023

BrandIndex, powered by YouGov, is a dynamic platform that consistently assesses the public perception of brands within competitive sectors on a weekly basis. This evaluation is achieved through the utilization of 16 indicators, which effectively measure the brands’ performance across the marketing funnel. As part of a comprehensive assessment process, KLA leverages the BrandIndex tool to analyse and evaluate over 190 brands spanning seven different sectors. The “Biggest Movers” analysis is specifically designed to identify brands that have undergone the most notable changes in their scores, as measured by three key metrics. By comparing results from the period of July 2022 to June 2023 with the previous 12-month timeframe, valuable insights into the brands’ performance and evolving public sentiment are unearthed[1].

The Overall Winners for 2023 – Remarkable Shifts Across Key Metrics:

Amidst the ongoing recovery from the impacts of Covid-19, South African consumers are confronted with the challenges of a tough economic environment. The constantly evolving consumer behaviour is influenced by factors such as escalating living expenses and other macro-environmental forces. Within this dynamic landscape, brands are compelled to showcase heightened resiliency to maintain their competitive edge.

The subsequent list highlights brands that have exemplified the most remarkable positive shifts year-on-year in three key metrics: Buzz, Index, and Consideration. These metrics serve as crucial indicators of the brands’ overall performance and perceptions among the target audience.

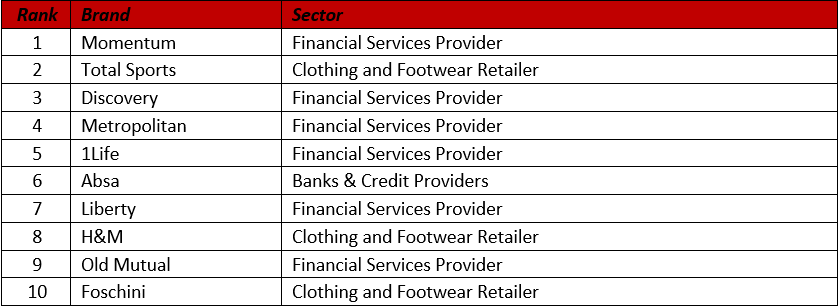

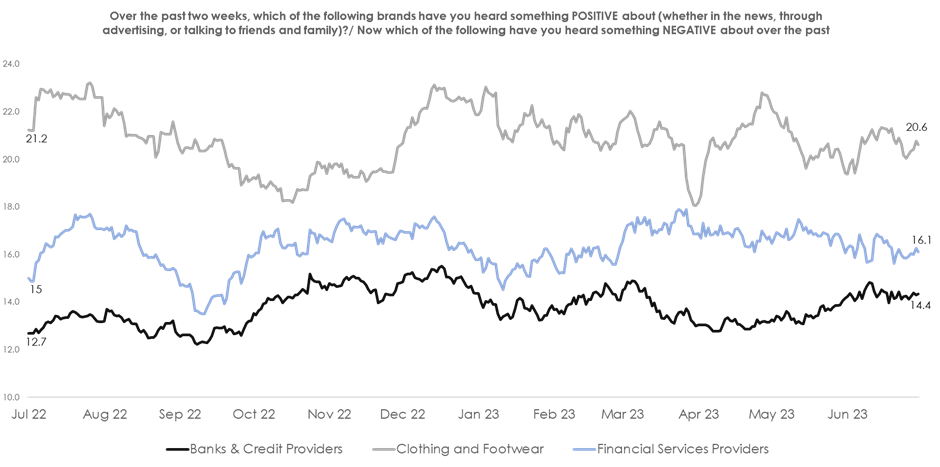

Biggest Movers: Buzz

Buzz is a measure of the extent of attention a brand garners from consumers. A positive net Buzz score indicates that the brand has received more favourable exposure than negative, leading to an enhanced overall sentiment towards the brand. Notably, brands within the banking and broader financial services sectors have emerged as the most successful in enhancing their Buzz scores compared to last year. Within highly competitive sectors, these brands have effectively captured consumer attention and positively influenced perceptions about their respective brands.

Positive Buzz Strategies and Spending Patterns:

Establishing positive brand buzz requires diverse strategies, ranging from traditional self-promotional marketing endeavours that often require substantial investments, whether they are always-on or periodic, to approaches that direct resources into other channels such as influencer marketing or empowering consumers to become brand advocates. Striking a balance between active promotion and organic conversation is crucial for brands to achieve optimal impact from their stretched budgets.

Analysing Nielsen’s Ad Intel media spend data[2], it becomes evident that Absa stands out as a brand that has achieved significant shifts in Buzz through investment in traditional media forms, particularly radio campaigns, during the first half of the year. Financial services, including the banking sector, are typically the largest spenders on marketing in South Africa, with the insurance sector also commanding a prominent presence due to the multitude of players in this space. Among the top 10 brands experiencing the most notable positive shifts in Buzz, three of them, namely 1Life, Discovery, and Momentum, are also among the top spenders in their respective categories. Notably, H&M ranks among the top spenders in the clothing and footwear retailer sector, while Total Sports and Foschini, both part of the TFG group, achieve gains in Buzz without spending at the same levels as their category peers.

As brand marketing teams allocate budgets in various ways, it becomes evident that employing multiple strategies and having adaptable plans is essential to sustain Buzz in a market influenced by diverse consumer decision-making factors.

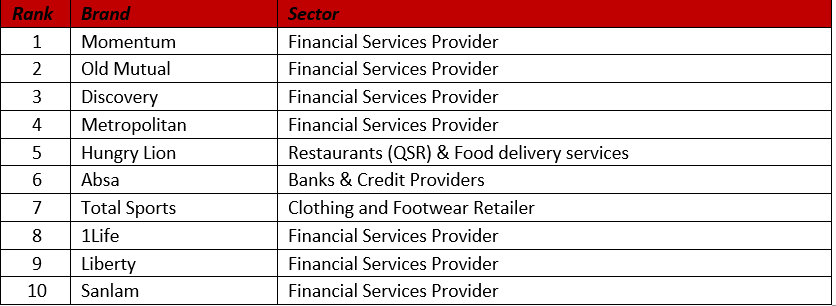

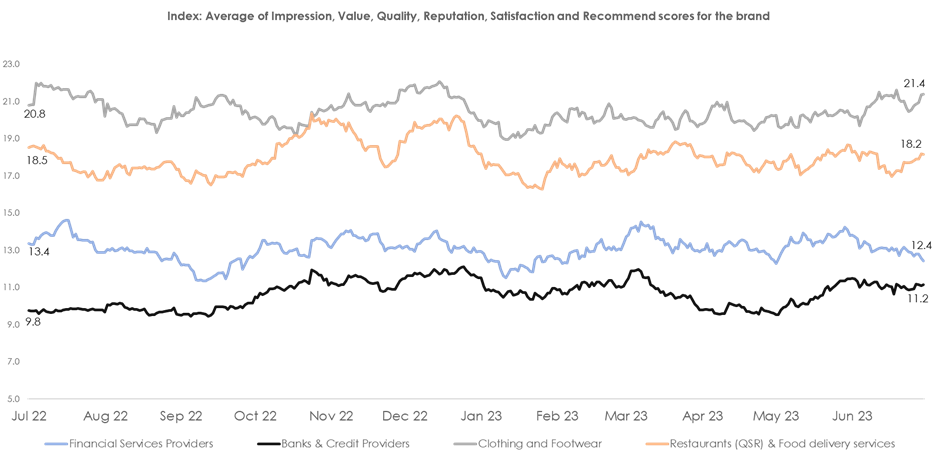

Biggest Movers: Index

The Index metric plays a pivotal role as a gauge of the overall consumer perception of a brand. A positive score in this area signifies that consumers have a strong belief in the brand, not only validating their confidence in the brand’s product or service offerings but also heightening the likelihood of consumers selecting this brand over others. A brand’s image (perception) represents what consumers expect in terms of quality and value from the product/service, so it’s crucial to cultivate and nurture a positive brand image to connect with the target audience, build trust, and foster loyalty amongst customers.

Brand Perception in Driving the bottom line:

If a brand receives more positive attention (Buzz), it’s likely that their overall brand perceptions will also be more positive. This is evident in the Top 10 Biggest Movers: Index, which closely align with the top brands on the Buzz list. Notably, financial service provider brands in the top 10 have improved their brand perceptions despite being in a category that, on average, experienced softer (YOY) performance. Sanlam joins its peers in driving significant YOY gains in brand perception despite not making the top 10 Biggest Movers on Buzz.

Interestingly, the Quick Service Restaurant (QSR) brand, Hungry Lion, is also among the top 10 Biggest Movers. In a cost-conscious environment, offering increased value can significantly influence consumer spending decisions and foster loyalty.

The significance of brand promise differs across sectors, and products or services with higher perceived risks, like insurance, heavily depend on their brand image to convey various messages to the market. According to Bain & Company’s report on customer behaviour and loyalty in insurance (Global Edition 2023), 80 percent of consumers are seeking a higher purpose from insurers[1]. Marketers face the challenge of striking a balance between brand building and simplifying / educating consumers about their products/services in an industry historically fraught with jargon and complexity.

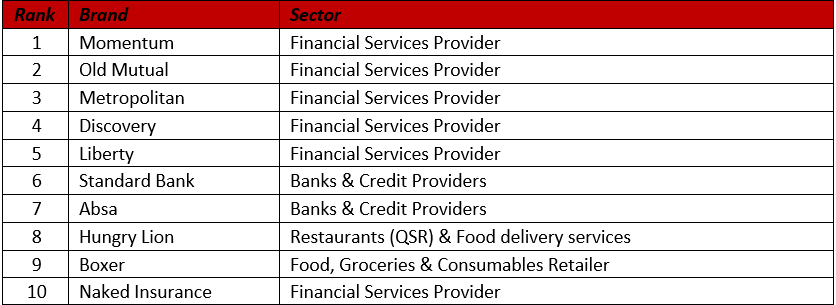

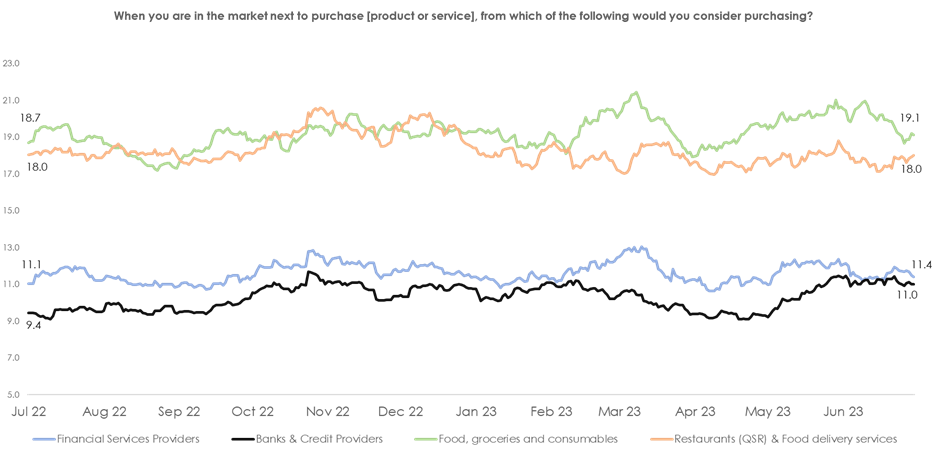

Biggest Movers: Consideration

Building brand awareness and fostering positive perception are crucial aspects of brand development. However, the Consideration metric is even more significant as it measures consumers’ potential to make a purchase, which is the ultimate goal of marketing. McKinsey’s research highlights how “brands in the initial consideration set can be up to three times more likely to be purchased eventually than brands that aren’t in it”[4]. In today’s reality of a non-linear marketing funnel, considering a brand early in the decision-making process becomes vital for driving usage, particularly in sectors with intense competition or in high-repertoire usage categories.

Among the seven sectors measured, the Banking & Credit Providers sector witnessed the most substantial gains in Consideration over the past year at an average sector level. The remaining sectors generally remained stable, with only marginal positive shifts in Consideration observed for the broader Financial Services Provider sector and the Food, Groceries, and Consumables Retailer sector.

Brand Growth and the Impact of Real-Time Insights:

Momentum, Old Mutual, Metropolitan, Discovery, Liberty, Standard Bank and Absa all benefit from the positive impact of gains in the top- and mid-funnel marketing metrics, leading to increased brand Consideration. While these larger and well-established brands dominate the list, newer and growing brands like Hungry Lion, Boxer, and Naked Insurance have also shown significant positive gains in Consideration compared to their previous year’s performance. Their success is evident as they secure positions within the top 10 Biggest Movers: Consideration.

The results above demonstrate significant positive shifts across key metrics in the marketing funnel, indicating brand growth within various sectors. However, it’s crucial to recognise that brands are now engaging with cash-strapped consumers, leading to a more discerning and value-conscious audience. This shift empowers consumers to play a more active role in decision-making, and brands that embrace and support this change will gain trust and loyalty. Brands that have a deep understanding and appreciation for the efforts required to attract and retain consumers often utilise real-time insights to adapt effectively to market changes, making timely decisions that contribute to their overall success.

For more information about what you can learn about your brand’s performance, please contact KLA at [email protected] or connect with us directly.

Brands & Branding 2023 Digital link: https://744a0732.flowpaper.com/BrandsandBranding2023/#page=89

[1] A year-on-year comparison from July 2021 – June 2022 vs July 2022 – June 2023 was made to assess significant changes across brands on 3 metrics that cover the top, middle and bottom marketing funnel. A brand is required to be tracked for a minimum of 6 months in the previous year to be included. Therefore, brands tracked after January 2022 have been excluded to allow for a fair comparison. This resulted in tracking of 138 brands in total.

[2] https://www.nielsen.com/solutions/media-planning/ad-intelligence/

[3] Source: https://www.bain.com/insights/customer-behavior-and-loyalty-in-insurance-global-edition-2023

[4] Source: https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-consumer-decision-journey